Extended Trading Hours

It has puzzled me for many years why stock exchanges hung onto such restricted trading hours – just 6.5 hours on weekdays – a structure that dates from a pre-computer, pre-globalization era. Finally, there is a move to change this – which is, in my opinion, about time!

International Demand

Foreign investors (including yours truly) currently have to trade in the middle of the night, which is far from ideal.

Investors in Europe, Asia and elsewhere would much prefer to trade U.S. stocks during their local business hours rather than staying up through the night for the U.S. market to open.

Crypto Competition

Retail investors have become accustomed to the 24/7/365 nature of cryptocurrency markets. Nasdaq is understandably reluctant to see trading activity migrate from traditional equities to digital assets simply because of access and convenience.

News Reaction

We have all experienced the frustration of a major geopolitical or economic event occurring while markets are closed, leaving investors unable to react for hours or even days. Alternative Trading Systems exist, but they are not a true substitute for a fully open exchange.

ATS – Alternative Trading Systems

These are off-exchange venues that execute trades at prices derived from the main exchanges, rather than from a continuous, fully liquid bid–ask market of their own. They are useful for cleaning up trades around the edges of the trading day, but liquidity is thin and price discovery is limited.

What Nasdaq is Proposing

Under Nasdaq’s proposal, the existing pre-market, regular market (9:30 a.m.–4:00 p.m. ET), and post-market sessions would be consolidated into a single “day session” running from 4:00 a.m. to 8:00 p.m. ET. A one-hour pause for system maintenance would follow from 8:00 p.m. to 9:00 p.m. ET. A new overnight “Night Session” would then operate from 9:00 p.m. to 4:00 a.m. ET.

The core 9:30 a.m.– 4:00 p.m. trading day would remain unchanged; the additional hours are purely additive.

When will it start?

Nasdaq has formally filed, and it may begin late 2026.

What does it mean for ITM?

Very little in practical terms. The core 9:30 a.m.–4:00 p.m. session will continue to operate as it does now, and the proposed changes do not alter it. For non-U.S. traders, extended hours will simply make trading more convenient — hooray, no more late nights.

In short, ITM is unaffected. This is an access improvement, not a strategy change.

To the markets . . .

Well, if there’s going to be a Santa rally it should be starting today! Traditionally, the Santa rally is the last 5 trading days of December and the first 2 trading days of January. That means this year it’s the (early) close on 24 December through to 5 January. Will it happen? We’ve looked at it on previous years and concluded the ‘Santa Rally’ didn’t really have legs. But checking the last 2 years:

- 2024: -1.55%

- 2023: -1.03%

So much for a ‘Santa Rally’!

SPY Charts

A bit more of the same – we’ve been going sideways for 3 months now. Boring.

On the long term chart SPY looks as though it is rolling over. It certainly doesn’t seem to want to stay in that trading channel. Shame.

SPYG Charts

SPYG is also trading sideways for the last 3 months. Just as boring.

Longer term, SPYG is still hugging the lower bound of the channel.

QQQ Charts

Similar to SPY, QQQ has been drifting sideways for 3 months. Again, boring. So much so that you start seeing things that may or may not be there to alleviate the boredom. I noticed a sideways triangle forming (blue arrows). The accepted ‘market wisdom’ is that as the triangle approaches its vertex there will be a breakout one way or the other. Well, that would be nice – if it goes up!

And on the long term chart, QQQ is slap bang in the middle of the trading channel.

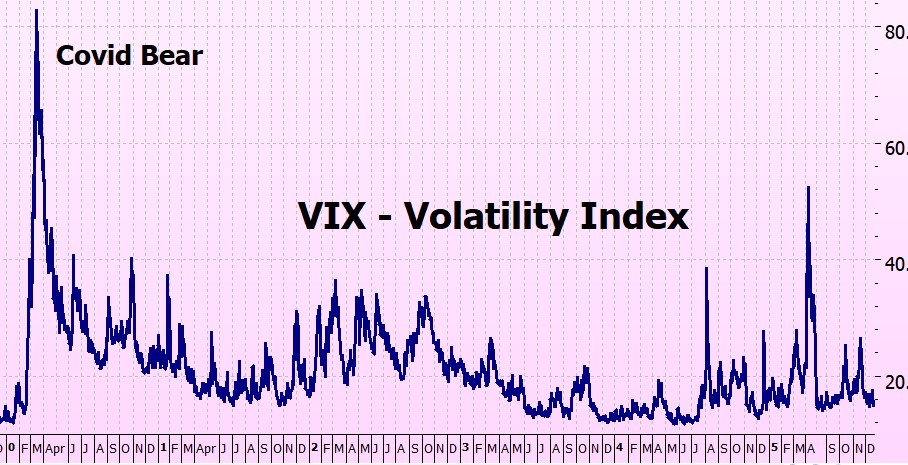

VIX Chart (Volatility)

The VIX is back under 20, the low volatility zone.

ITMeter

The week ahead . . .

I expect trading to be very light as it is Christmas. The light trading means that it takes very little to move the market so volatility can reign for during this period – something I am recognizing and incorporating in my new book.

It’s also a relatively light week for announcements. Here it is day by day:

- Monday (Dec 22)

- No major scheduled US economic releases

- Normal trading

- Tuesday (Dec 23)

- US GDP (Q3, revised)

- Consumer Confidence (Dec)

- Possible delayed releases: Durable Goods Orders

- Wednesday (Dec 24 – Christmas Eve)

- Weekly Initial Jobless Claims

- NYSE early close: 1:00 pm ET

- Thursday (Dec 25 – Christmas Day)

- NYSE closed

- Friday (Dec 26)

- No major scheduled data

- Normal trading session

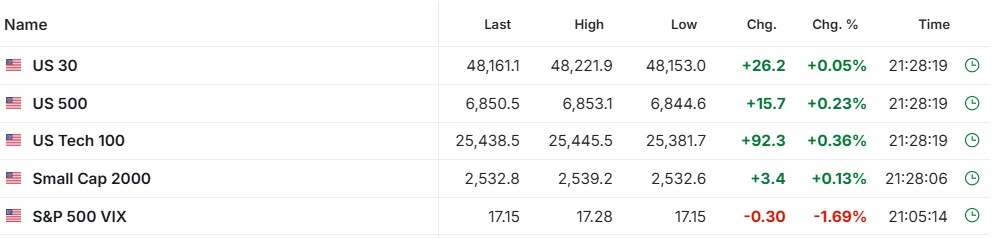

The futures . .

. . are looking somewhat optimistic, but it is still 12 hours to market open.

Merry Christmas!

Happy New Year!

The ITM Blog is taking a break over Christmas and will be back on the 5th January.

I hope you have a wonderful Christmas and that next year will be your best ever!

Signing off from sunny WA – here’s the beach last night, the summer solstice.

Beautiful!

Heather

Trade the tide, not the waves

12 Responses

Dear Heather,

There are three more trading days of December 29 and 30 and 31 of 2025 and people are taking profits now to lock in the gains. Happy Holidays and Happy New Year to everyone.

Dear Heather,

You mention before that it is better to state the gains and losses in terms of percentage. However, I would like to state it in terms of amount gains and amount losses. My account starting in January 2025 was almost $14,000 and now in December 2025, it is over $19,000 with an amount gain of about $5,000. I would like to thank Heather Cullen and the ITM Community for helping me with my journey pf financial independence and financial freedom.

Happy Holidays and Happy New Year to Everyone.

I just read your latest blog post and want to thank you for the work you do for all the ITM investors and the knowledge you share.

I tried all sorts of trading and investment approaches the last 20+ years and this year I totally switched to ITM and my account is sitting on an incredible 32.78% for the year. That is amazing to say the least.

I wish you a merry Christmas and a happy new year!

HI Bart – thank you for your kind words and I am completely delighted at your success, and so glad you are happy with ITM!

x

h

Hi Heather, I’ve enjoyed reading your books and as soon as I have practiced a little more on the Demo account I will start trading DITM options exactly as you have set out. My question is for recording. What do you suggest I keep a track of for every call I open and then roll or close? I am not very good at creating spreadsheets so it has to be pretty simple! Cheers, Jackie

HI Jackie

I don’t keep separate spreadsheets to keep trach of my positions – I just use the broker platform for that.

What I do every week or so is that I will download my positions – on your broker platform you will probably see a ‘download’ button – and then I use Excel to check percentages allocated, strikes, dates etc.

It depends on how many positions you are opening – I try to limit the different strikes that I buy – so, for example, I would rather buy 10 options with a strike of $340 rather than 1 of $330 and 1 of $335 etc. It makes your account easier to keep track of in your head.

I’ve always found that when I make cool spreadsheets I keep them updated for a few days – then they lapes and are completely useless.

Hope this helps

h

Extended Trading Hours – Volume will probably be much lower than the traditional trading session. Currently option volume is accelerating much faster than stock trading volume. I believe the extended trading sessions will not include option trading. As a result Bid/Ask spread in extended trading maybe to wide or suboptimal for traders.

You are absolutely right – I totally missed that options were not included – I assumed that they were and proceeded on that basis – quelle surprise!

Seems as though there are no immediate plans to include it either – so my celebrations were a little early.

With the size of the options market you would have thought that they would include it – I’ll have to do more research.

Thank you for bringing this to my attention.

x

h

Thanks, Heather, for the weekly update. For the 2025 year to date of my personal portfolio implementing the ITM Method, it has returned so in the 25%. Let’s hope for a good last week of December of 2025 and a good first week of January of 2026.

well, last night wasn’t too bad!

Fingers crossed for tonight!

x

h

Merry Christmas and Happy New Year to you, Heather, and thank you so much.

And to you too!

x

h